Bangladesh’s capital market is undergoing its worst crisis in a decade. Daily turnover, which stood at Tk 1,500 crore just two months ago, has now collapsed to only Tk 300 crore. Thousands of investors have suffered severe capital erosion, with many effectively wiped out. Market observers say this downturn is not a natural correction but the direct outcome of few controversial regulations: the Closure of five listed banks, Margin Rules and the Mutual Fund Rules 2025.

Industry stakeholders allege that a deliberate plan to phase out closed-end mutual funds. Compared with global markets, Bangladesh now faces extraordinary challenges, aggravated by policies introduced during a previous regime that severely damaged the market. Those harmful elements, they claim, remain active today. Stakeholders argue that the sector needs urgent attention from the government and top policymakers.

Over the past two decades, fixed-term mutual funds have been a key source of market stability, new investor participation, and portfolio diversification. The sector has expanded from Tk 2,000 crore in 2008 to more than Tk 10,000 crore today. As the industry grew, investors enjoyed consistent returns. Data shows that fixed-term funds have distributed Tk 1,351.33 crore in cash dividends over the last five years an important contribution during a prolonged market slowdown.

Cash Dividends by Closed-End Funds (2019–2024)

Closed-End Funds as Market Stabilizers

Closed-end mutual funds have long performed as institutional investors that help maintain market balance, particularly during volatility.

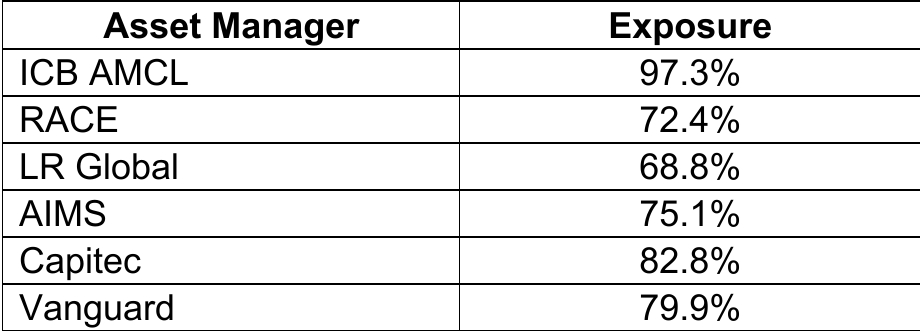

Market Exposure of Closed-End Funds

These figures show that the most the Mutual fund’s assets remain invested directly in the capital market, helping to prevent further deterioration. However, sector insiders warn that misrepresentation, misguided interpretations, and targeted campaigns by certain officials and vested groups have pushed this vital industry to the brink. They argue that regulators cannot avoid responsibility for the current market turmoil, yet attempts are being made to shift blame onto Market intermediaries.

Industry Response

Dr. AKM Mazharul Islam, Senior Advisor (Regulatory Affairs) at the Association of Asset Management Companies & Mutual Funds, expressed deep concern. He stated:

“Eliminating a Tk 10,000 crore industry built over 20 years is not an achievement, nor will it bring any positive outcome for the capital market. The forced liquidation of closed-end funds will inject massive sell pressure into an already weak and illiquid market. A substantial amount of capital will inevitably exit the market.”

He added that millions of investors and thousands of families depend directly or indirectly on this sector. “Why the regulator is pursuing such a decision remains unclear. Globally, such an approach is unprecedented, and Bangladesh has never taken a step of this nature in its market history.”

According to Dr. Mazhar, stakeholders have already communicated their position to the BSEC, but the Commission appears focused solely on rapid implementation of the new regulations, with limited regard for stakeholder input or legal justification.

A Strategic Policy Mistake?

Closed End mutual funds have long served as a reliable, tested, and stabilizing investment vehicle in Bangladesh. While global markets continue strengthening this segment, Bangladesh is now moving in the opposite direction, a move many consider destabilizing and risky. Closed-end funds enhance market depth and support economic activity.

Stakeholders argue that the strategic priority should be protection, modernization, and expansion, not redemption. At a time when the economy is standing at the edge of a severe downturn, shutting down Closed End mutual funds could push the market into deeper crisis.