Special Correspondent : The turnover of the Dhaka Stock Exchange (DSE) dipped below Tk300 crore for the first time in four months as investors are also staying on the sidelines to observe the market's momentum amidst the ongoing earnings disclosures of the listed companies.

On Tuesday, the daily turnover was Tk291 crore, lowering 36% from the previous session.

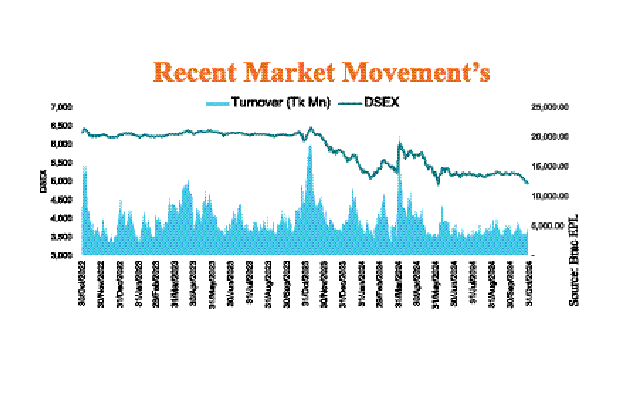

The key index DSEX of the DSE lost 17.18 points and closed at 4,935.62. The blue-chip index DS30 (-0.36%), the Shariah-based index DSES (-0.27%), and the large-cap index CDSET (-0.35%) closed at 1,824.22, 1,093.95, and 1,013.22 points, respectively.

Meanwhile, volume dipped by 14% and turnover decreased by 36%. Six sectors out of 19 were the gainers, and 13 were on the losing side. Of the 395 scrips traded, 136 advanced, 211 declined, and 50 remained unchanged.

BRACBANK topped the turnover chart. DELTASPINN was the top gainer, whereas POWERGRID was the top loser.

In the block market, shares of Tk 6.2 crore were transacted, representing a turnover of 2.13%. The SME index, DSMEX, decreased by 3.66 pts, and the market generated a Tk1.9 crore turnover, a 51% decrease from the previous session.

According to the Royal Capital Financial Portal, BXPHARMA and SQURPHARMA contributed the most to the gains and the losses of the DSEX index on the day, and the bear ultimately wins today after a day-long fight with the bull.

In its daily market commentary, the EBL Securities said that the struggling capital market observed another volatile session in absence of any decisive catalyst for reviving investor sentiment, while investors are also staying on the sidelines to observe the market's momentum amidst the ongoing earnings disclosures of the listed companies.

Market volatility persisted throughout the session as sellers maintained their dominance amid uncertainties over the market outlook, while favorable earnings disclosures from particular companies enticed some investors to shift their positions to those stocks for a potential quick return.

Most of the large-cap sectors posted negative performance on the day. NBFI experienced the highest loss of 2.06% followed by Fuel & Power (-1.78%), Bank (-0.92%), Telecommunication (-0.60%), Food & Allied (-0.26%), Pharmaceutical (-0.09%), and Engineering (+0.19%), respectively. Block trades contributed 2.1% of the overall market turnover.

BRAC Bank was the most traded share with a turnover of Tk 26 crore.

The port city bourse, Chittagong Stock Exchange (CSE), however, settled on red terrain. The Selective Categories' Index (CSCX) and All Share Price Index (CASPI) fell by 21.8 and 30.7 points, respectively.