Special Correspondent: The key index of the Dhaka bourse failed to sustain its short-lived positive vibe from the previous session as jittery investors resumed offloading their holdings to limit further losses.

DSEX, the key index of the Dhaka Stock Exchange (DSE) lost 42.67 points and closed at 4,952.79. The blue-chip index DS30 (-1.17%), the Shariah-based index DSES (-1.01%), and the large-cap index CDSET (-0.66%) closed at 1,830.82, 1,096.88, and 1,016.75 points, respectively.

All the large-cap sectors posted negative performance on Monday. Fuel & Power experienced the highest loss of 2.31% followed by NBFI (-1.85%), Telecommunication (-1.48%), Engineering (-1.23%), Pharmaceutical (-0.65%), Food & Allied (-0.59%), and Bank (-0.11%), respectively. Block trades contributed 25.4% of the overall market turnover. Midland Bank Limited was the most traded share with a turnover of Tk 165 million.

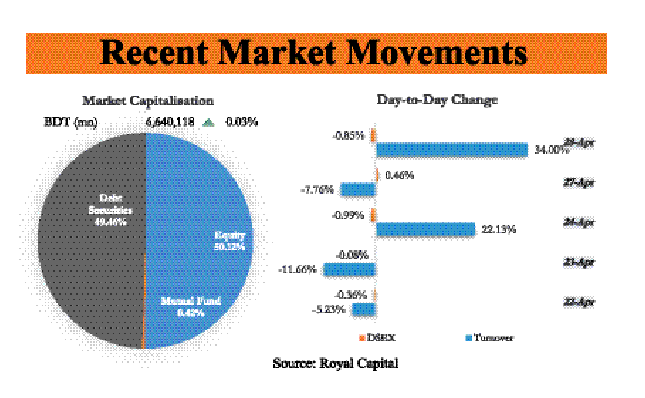

In contrary, market turnover increased by 34.0% to Tk 4.5 billion as against Tk3.4 billion in the previous session. Only 1 sector out of 19 was the gainer, and 18 were on the losing side. Of the 395 scrips traded, 94 advanced, 246 declined, and 59 remained unchanged.

MIDLANDBNK topped the turnover chart. EMERALDOIL was the top gainer, whereas PROGRESLIF was the top loser.

In the block market, shares of Tk115.2 crore were transacted, representing a turnover of 25%. The SME index, DSMEX, increased by 6.41 pts, and the market generated a Tk3.9 crore turnover, a 50% increase from the previous session.

According to the Royal Capital Financial Portal,LHBL and SQURPHARMA contributed the most to the gains and the losses of the DSEX index on the day, and the bear dominated the market throughout the day.

On Sunday, DSE saw a turnaround on Sunday as its key index, DSEX rose 22 points to close at 4,995, ending a nine-day losing streak.

In its daily market commentary, the EBL Securities said that the benchmark index of the capital bourse failed to sustain its short-lived positive vibe from the previous session as jittery investors resumed offloading their holdings to limit further losses due to lack of any strong positive catalysts for the market to rebound from its lingering depressed sentiment.

Although the market opened on a slight positive note, selling spree soon emerged to fade the initial optimism and dragged down the market indices again to negative territory with bears regaining control of the market's momentum.

The port city bourse, Chittagong Stock Exchange (CSE), also witnessed a negative session today. The selected indices (CSCX) and All Share Price Index (CASPI) decreased by 10.7 points and 14.4 points, respectively.