Special Correspondent

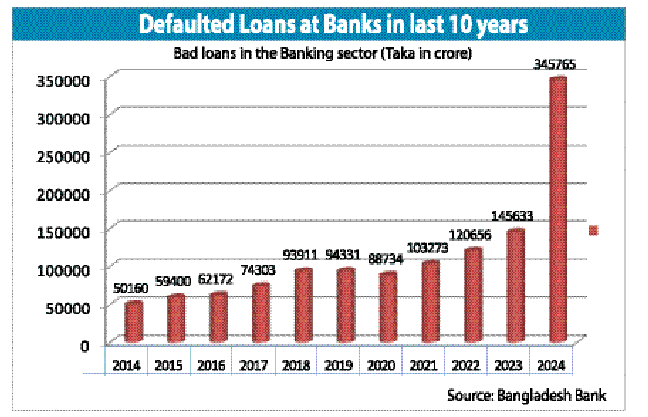

At the end of December 2024, non-performing loans (NPLs) in Bangladesh surged to Tk 345,764 crore, accounting for 20.2% of the total loans in the banking sector, according to Bangladesh Bank data released on Wednesday.

Briefing the reporters, BB Governor Dr. Ahsan H. Mansur said the ratio of bad loans would continue to rise in the coming days as the regulator has no intention to show a controlled figure.

As per data, the rate of NPL in government banks rose to 42.80%, while the ratio in private banks was 15.6%.

The Bangladesh Bank governor said the rise in NPLs is largely due to a long-standing lack of transparency in reporting bad loans and changes in loan classification policies.

Meanwhile, the amount of NPLs was Tk1.45 trillion at the end of 2023.

As of December 2024, at least 42% of total loans in state-owned banks were classified as non-performing, and 15% of total loans in private banks were non-performing, said Bangladesh Bank.

Previously, loans were classified as overdue after 270 days, but the timeframe has now been reduced to 180 days. Furthermore, starting from April 2025, loans will be classified as non-performing within just 90 days.

The governor warned that with this new policy, NPLs are expected to rise even further in the coming months.

According to central bank data, NPLs stood at Tk 284,000 crore at the end of September last year, which was 16.93 per cent of total outstanding loans at the time. This means bad loans surged by Tk 61,000 crore in just three months.

The governor also said that some banks have to be merged for their better management. But the deposits of banks are guaranteed by the state, so no one should worry regarding deposits in banks.

He also assured that there is no crisis in the financial sector now and there will not be shortly. The reserve has crossed US$ 21 billion as per IMF standards.

Exchange rates, balance of payment, and current account show a stable and positive trend now, he said.

A drafted law has been scrutinised by the finance ministry. After making the Act, the central bank will make decisions regarding some troubled banks, he said.

He also emphasized that depositors will not be affected by any decision of the central bank.

In 2023, Bangladesh's banking sector faced a significant surge in distressed assets, reaching nearly Tk 5.5 lakh crore by the year's end. This figure encompasses defaulted loans, rescheduled loans, write-offs, and loans unclassified due to court orders. The central bank's Financial Stability Report for 2023 highlighted that defaulted loans alone amounted to Tk 1,45,633 crore, with rescheduled loans at Tk 2,88,540 crore and write-offs totalling Tk 53,612 crore. Additionally, approximately Tk 60,000 crore in loans remained unclassified because of court-issued stay orders.

This escalation in distressed assets was partly attributed to lenient rescheduling policies introduced by the Bangladesh Bank in 2022, allowing banks to reschedule loans with reduced down payments and extended repayment periods. Such policies led to a 35.6% increase in rescheduled loans compared to the previous year.

Non-bank financial institutions (NBFIs) also experienced a deterioration in asset quality. Defaulted loans in this sector surged to a record Tk 23,208.7 crore by the end of 2023, accounting for 32% of total disbursed loans. This rise was largely due to previous loan irregularities and scams, with the central bank's supervision being called into question.

Economists and industry experts have expressed concerns over the increasing trend of bad loans, citing factors such as political or business influences in credit disbursement, lack of good governance, and relaxed policies by the central bank. The growing volume of non-performing loans has been identified as a significant challenge, with calls for stricter regulations and improved oversight to address the issue.

The situation underscores the need for comprehensive reforms in Bangladesh's financial sector to enhance governance, accountability, and transparency, aiming to curb the rising trend of distressed assets and ensure the sector's stability.